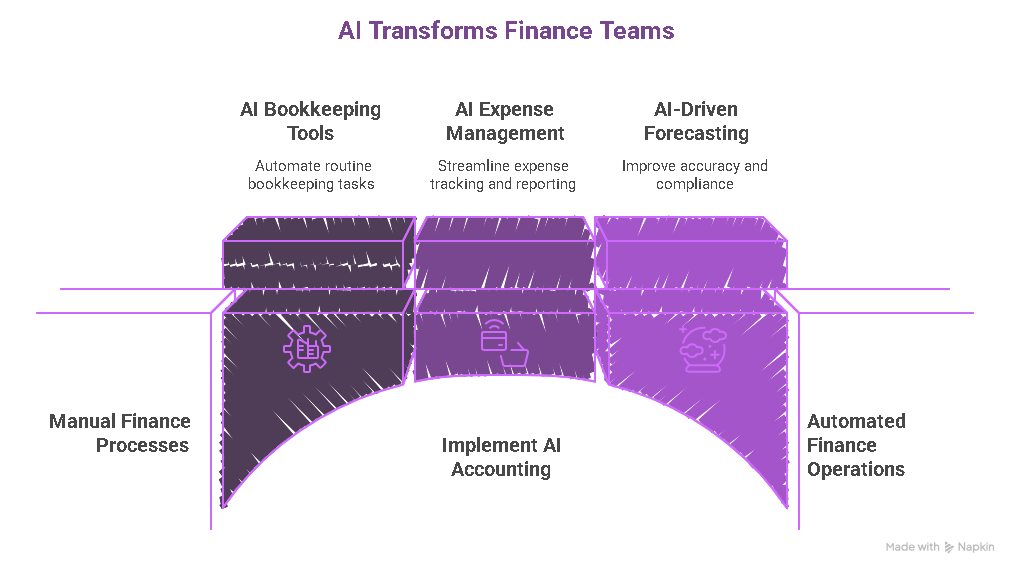

Today's finance teams must deal with a never-ending supply of spreadsheets, laborious data entry, and manual reconciliations. There is little time for strategic decision-making because accountants spend hours processing invoices, monitoring spending, and maintaining financial reports.

This is where finance automation tools and AI accounting software are changing the game. Complex financial data can now be processed by artificial intelligence more quickly than before, increasing forecasting, accuracy, and compliance. 2025 is looking to be the year that finance becomes completely digital and intelligent, from AI-driven expense management to AI-powered bookkeeping tools.

The top 8 AI tools for finance teams in 2025 will be discussed in this blog, which will assist accountants, CFOs, and business owners in automating repetitive tasks, improving insights, and making more informed financial decisions based on data.

Here’s a complete list of the top AI-powered finance and accounting tools every team should consider in 2025.

Table of Contents

What Are AI Tools for Finance & Accounting Teams?

Bookkeeping, forecasting, auditing, and expense tracking are just a few of the standard financial tasks that can be automated with the help of artificial intelligence and machine learning. These tools provide precise insights for improved decision-making, minimize human error, and analyze enormous volumes of data in real time. Finance teams can save time, increase compliance, and concentrate on strategic financial planning with the help of AI forecasting platforms and accounting software that automatically reconciles transactions.

Quick Comparison: Best AI Tools for Finance (2025)

Before diving deep into each platform, here’s a quick side-by-side comparison of the best AI tools for finance and accounting in 2025. This table highlights their pricing, best use cases, and standout features to help you choose the right solution for your business.

| Tool Name | Best For | Pricing | Key Feature |

|---|---|---|---|

| Vic.ai | Expense automation & invoice processing | Custom | AI-based invoice and spend analysis |

| Datarails | FP&A and financial forecasting | From $40/month | Automated reporting & data consolidation |

| Docyt | Real-time bookkeeping automation | Custom | AI-powered reconciliation & document capture |

| ScaleFactor | Accounting & business insights for SMBs | From $50/month | Automated bookkeeping & expense categorization |

| Fyle | Expense reporting & card management | From $6.99/user/month | AI expense detection from email receipts |

| Trullion | Compliance & audit automation | Custom | AI contract recognition for audits |

| Zeni.ai | Finance automation for startups | From $499/month | Real-time bookkeeping with ML-based forecasting |

| Corcentric | Enterprise finance workflow automation | Custom | AI procurement, payments & reporting integration |

AI Accounting & Finance Tools Overview (2025)

Artificial intelligence is revolutionizing how finance teams work from automating bookkeeping and expense management to forecasting and compliance. These AI accounting software solutions simplify complex tasks, reduce human error, and give finance leaders more time for strategic planning.

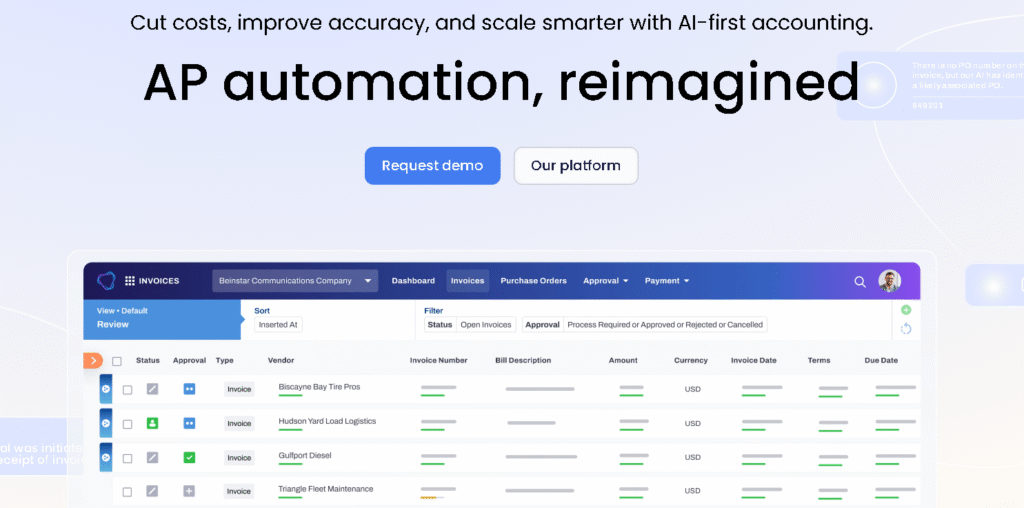

1. Vic.ai

Overview:

Vic.ai is one of the most advanced AI accounting software platforms focused on automating invoice processing and expense management. It uses machine learning to analyze, approve, and post invoices automatically drastically cutting manual entry time for finance teams.

Key Features:

- AI-based invoice reading and categorization

- Real-time expense analytics

- Smart approval workflows for finance managers

- Automated compliance and audit trails

Pricing: Custom (based on company size and transaction volume)

Best For: Mid-size to large enterprises and CFOs managing complex expense cycles

Pros: Exceptional accuracy and integration with ERP systems

Cons: Setup requires data mapping for large organizations

Transition:

While Vic.ai focuses on automating invoices and expenses, Datarails empowers finance teams to make smarter decisions with AI-driven planning and forecasting.

2. Datarails

Overview:

Datarails is a top-rated AI finance software that automates FP&A (Financial Planning & Analysis). It consolidates data from multiple systems like Excel, ERP, and CRMs, then applies AI to generate financial forecasts, reports, and scenario models in real time.

Key Features:

- Automated consolidation and reporting

- Budgeting and forecasting with AI predictions

- Cloud-based collaboration for CFOs and analysts

- Smart dashboards for financial performance insights

Pricing: Starts at $40/month per user

Best For: Finance teams, CFOs, and FP&A professionals

Pros: Reduces manual Excel work by 80%

Cons: Limited customization for smaller firms

Transition:

If Datarails simplifies forecasting, Docyt is revolutionizing how accountants handle day-to-day bookkeeping with real-time automation.

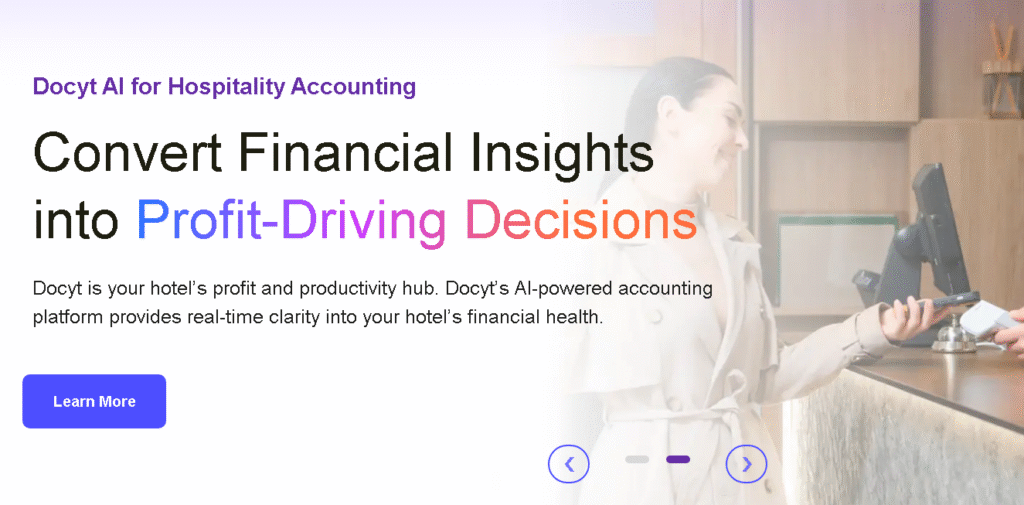

3. Docyt

Overview:

Docyt is a next-gen AI bookkeeping tool designed to automate accounting workflows. It uses machine learning to reconcile transactions, categorize expenses, and generate reports automatically perfect for finance teams looking for accuracy and speed.

Key Features:

- Automated reconciliations across accounts

- AI-powered document and receipt capture

- Real-time profit and loss dashboards

- Compliance automation for audits

Pricing: Custom plans available

Best For: Accountants, bookkeepers, and small businesses

Pros: Excellent automation for repetitive tasks

Cons: Limited integrations with legacy accounting systems

Transition:

While Docyt handles bookkeeping, ScaleFactor brings full-scale AI accounting and financial intelligence for small and growing businesses.

4. ScaleFactor

Overview:

ScaleFactor is an intuitive AI accounting platform that automates bookkeeping, payroll, and forecasting for small to mid-sized businesses. It provides AI-powered financial insights, helping business owners understand their cash flow, expenses, and profitability in real-time.

Key Features:

- Automated bookkeeping and payroll

- Real-time business insights and dashboards

- Forecasting and budget planning tools

- Integrates with QuickBooks and Xero

Pricing: Starts at $50/month

Best For: Startups, SMBs, and growing businesses

Pros: Easy to use; integrates with popular tools

Cons: Best suited for non-enterprise-scale companies

Transition:

If ScaleFactor simplifies small-business accounting, Fyle brings next-level automation to corporate expense reporting and card reconciliation.

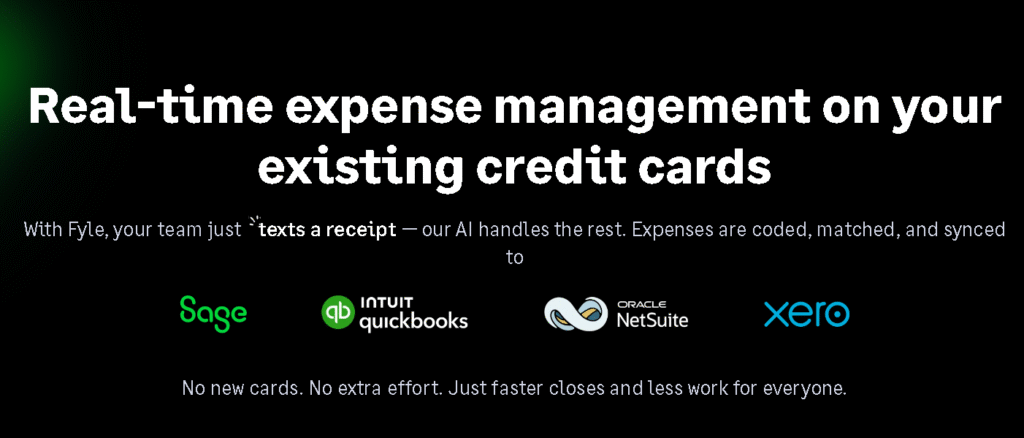

5. Fyle

Overview:

Fyle is a modern AI-driven expense management tool that automates receipt tracking and reimbursement for finance teams. It reads receipts directly from emails, cards, or mobile uploads and matches them to transactions automatically.

Key Features:

- AI expense extraction from Gmail and Outlook

- Real-time spend visibility for managers

- Policy checks and compliance automation

- Integration with ERP and accounting software

Pricing: Starts at $6.99/user/month

Best For: Small businesses and corporate finance teams

Pros: Streamlines reimbursement and spend management

Cons: Mobile experience can vary by device

Transition:

While Fyle excels at expense tracking, Trullion stands out for its AI audit and compliance capabilities ideal for enterprises and auditors.

6. Trullion

Overview:

Trullion leverages machine learning in accounting to automate complex audit processes. It uses AI to extract data from contracts and financial documents, improving accuracy in lease accounting, compliance, and financial reporting automation.

Key Features:

- Automated contract recognition

- Compliance-ready financial reports (ASC 842, IFRS 16)

- Real-time audit trail visibility

- Cloud-based AI accounting integration

Pricing: Custom quote

Best For: Enterprises, auditors, and CFOs

Pros: Increases transparency and compliance accuracy

Cons: Requires onboarding for new teams

Transition:

For startups that want an all-in-one financial automation partner, Zeni.ai offers a complete AI accounting solution with intelligent forecasting and workflow management.

7. Zeni.ai

Overview:

Zeni.ai is a cloud-based AI accounting software designed specifically for startups. It manages bookkeeping, invoicing, payroll, and forecasting in one intelligent dashboard powered by machine learning and automation.

Key Features:

- Automated bookkeeping and expense tracking

- AI forecasting for revenue and cash flow

- Real-time financial dashboards

- Collaboration tools for startup founders and CFOs

Pricing: Starts at $499/month

Best For: Startups and fast-growing SaaS businesses

Pros: Excellent accuracy; integrates with Stripe and Gusto

Cons: May be costly for early-stage startups

Transition:

For enterprises that need complete control over procurement, compliance, and payments, Corcentric is a powerful end-to-end AI finance automation software.

8. Corcentric

Overview:

Corcentric offers AI-based finance workflow automation for large enterprises. It unifies procurement, payments, and invoicing under one intelligent platform, using AI for financial reporting, compliance, and spend optimization.

Key Features:

- Automated invoice-to-pay workflows

- AI-powered financial analytics and reporting

- Intelligent spend management software

- Compliance and audit automation

Pricing: Custom

Best For: Large enterprises and CFOs managing complex workflows

Pros: Excellent scalability and analytics features

Cons: Requires IT support for full integration

Best AI Tools for Finance by Use Case (2025)

| Use Case | Recommended Tools |

|---|---|

| Best for Small Businesses | Fyle, Zeni.ai |

| Best for Enterprises | Datarails, Corcentric |

| Best for Accountants | Vic.ai, Docyt |

| Best for Financial Planning & Forecasting | ScaleFactor, Trullion |

Why AI Is the Future of Finance & Accounting

These days, finance teams are strategic partners rather than merely mathematicians. By 2025, AI automation in finance will free up professionals to concentrate on analytics, forecasting, and business expansion rather than tedious data entry.

These developments, which range from AI-powered reporting tools to robotic process automation for accountants, result in:

- Faster financial closes

- Improved accuracy and compliance

- Predictive insights for better decision-making

AI doesn’t replace accountants it empowers them to work smarter.

FAQs: AI Tools for Finance (2025)

Q1. What are the best AI tools for finance teams in 2025?

Top AI tools for finance teams 2025 include Vic.ai, Datarails, Docyt, ScaleFactor, Fyle, Trullion, Zeni.ai, and Corcentric. These tools automate bookkeeping, forecasting, expense management, and compliance tasks, saving teams hundreds of hours monthly.

Q2. Can AI replace accountants?

AI won’t replace accountants it enhances their capabilities. While automation handles repetitive processes like reconciliation and data entry, human accountants still provide strategic insights, financial planning, and judgment that AI cannot replicate.

Q3. How do AI tools improve financial reporting accuracy?

AI tools eliminate manual entry errors by automating data collection, classification, and validation. With AI-powered financial analytics and intelligent reconciliations, finance teams get real-time, accurate reports that support better decision-making.

Q4. Are AI accounting tools safe and compliant?

Yes. Most AI accounting platforms (2025) follow international security and compliance standards such as SOC 2, GDPR, and ISO 27001. They also include built-in AI compliance automation features to ensure accuracy in audits and reporting.

Q5. Which AI software is best for small finance teams?

For small teams or startups, Fyle and Zeni.ai are the best options. They offer affordable AI bookkeeping tools and easy integration with existing accounting software, helping small finance teams manage expenses and cash flow efficiently.

Conclusion

AI enables accountants to work more efficiently rather than replacing them.

In 2025, artificial intelligence is changing the way accounting and finance teams work. These tools, which range from finance automation platforms like Corcentric to AI accounting software like Vic.ai, improve the accuracy of financial decision-making by doing away with manual labor.

Professionals in finance are not replaced by automation; rather, it frees them up to concentrate on strategy, forecasting, and company expansion.

At tooljunction, we share honest AI tool reviews and tutorials to help you choose the right tools for your creative projects.